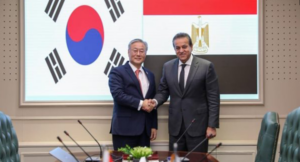

Khaled Abdel Ghaffar, Egypt’s Deputy Prime Minister for Human Development and Minister of Health and Population, has met South Korean Ambassador to Egypt, Kim Yonghyon, to discuss bilateral cooperation in healthcare, human resource development, and South Korea’s biomedical investments.

A key outcome of the meeting was the launch of a $9m grant project aimed at improving emergency medical services in Upper Egypt, particularly in the Nag Hammady and Luxor region. This initiative aligns with Korea’s ongoing railway signal modernization projects, including the Nag Hammady–Luxor Corridor Signaling System Modernization Project (active since 2021) and the upcoming second-phase Luxor–High Dam Corridor project. The new healthcare initiative seeks to enhance emergency response capacity for railway-related accidents and other medical emergencies.

Starting next year, the project will introduce mobile clinics, upgrade emergency rooms, provide advanced medical equipment, and offer specialized training for emergency medical personnel. These measures aim to improve healthcare accessibility and strengthen Egypt’s overall emergency response, particularly in rural areas.

During the meeting, Ambassador Kim also highlighted the Dr. LEE Jong-wook Fellowship Program, named after the former WHO Director-General, and invited Egyptian healthcare professionals to participate. Organized by the Korea Foundation for International Healthcare (KOFIH), the program has trained 1,500 professionals from 30 countries since 2007, offering courses on clinical expertise and health policy. This year marks Egypt’s first participation, focusing on infectious disease response and health policy leadership.

Further strengthening Korea-Egypt biomedical collaboration, Ambassador Kim announced a joint $10 million investment by Korea’s ChoonAng Vaccine Lab (CAVAC) and Egypt’s Global Pharmaceutical Industries (GPI) to establish a poultry vaccine production facility in Al-Sadat City’s Industrial Polaris Area. Set for completion by June, the facility will operate under an OEM model, contributing to Egypt’s export market.

Ambassador Kim also invited Deputy Prime Minister Ghaffar to a reception on April 13 celebrating 30 years of diplomatic relations. The accompanying economic conference will serve as a platform to discuss biomedical and healthcare cooperation, underscoring Egypt’s growing role as a medical hub in the Middle East and Africa.

As part of broader efforts to boost Korea-Egypt healthcare collaboration, KOTRA’s Egypt office is organizing a Korean Biomedical Business Delegation visit in September. The delegation will engage in B2B meetings with Egyptian companies to foster investment and expand healthcare partnerships. Additionally, Ambassador Kim proposed B2G discussions with Egypt’s Ministry of Health, including a policy seminar on key healthcare initiatives.

Deputy Prime Minister Ghaffar welcomed these initiatives and reaffirmed Egypt’s commitment to strengthening cooperation with Korea. Both sides also explored potential collaboration on health insurance policy development to support Egypt’s Universal Health Coverage goals. DailynewsEgypt